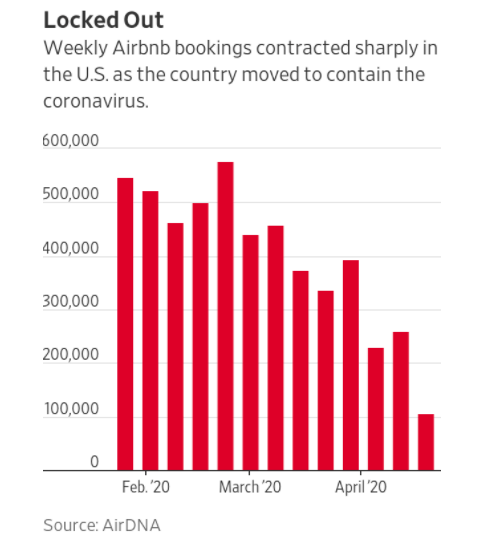

In March, Airbnb lost $1.5 billion in canceled bookings according to AirDNA. Weekly Airbnb U.S. bookings through April dropped sharply.

Hosts with two to 24 properties account for one-third of Airbnb’s U.S. listings for entire homes or apartments (excluding shared rooms), based on AirDNA estimates. The larger STR companies with more than 25 properties account for another third. Hosts with a single property make up the remaining third. Airbnb declined to comment on the data, only saying that more than 70% of hosts world-wide have only one listing, and those listings account for about 50% of Airbnb’s listings. The Airbnb data reflects worldwide listings and likely include shared rooms.

Small entrepreneurs who built mini-empires of Airbnb properties – hosts with two to 24 properties – suffer the greatest blow financially. They bought or leased residential properties to list on Airbnb. These entrepreneurs are generally self-financed through borrowings unlike large STR operators such as Sonder and Lyric who are backed by venture capital.

From the WSJ:

Smaller players have spent hundreds of thousands of dollars each buying homes for short-term rentals. Jennifer Kelleher-Hazlett of Clawson, Mich., spent about $380,000 to buy two Michigan properties in 2018. She said she and her husband cashed out their financial investments and borrowed $100,000 from employers to furnish them.

The 47-year-old expected to net up to $7,000 a month from Airbnb after mortgage payments, supplementing her income as a part-time pharmacist and her husband’s as a schoolteacher. Before the virus struck, the couple was considering buying more homes. Now, they can’t make mortgage payments because no one is booking, she said. “We’re either borrowing more or defaulting.”

The Phoenix market is one example of the dire straits that some of these small entrepreneurs are facing. Some are desperately unloading properties around Phoenix.

From CBS News:

Hundreds of homeowners and investors poured millions of dollars into expensive mortgages across the Phoenix area, banking on the idea that these rentals would pay the bills and then some – every month.

But according to the website, AirDNA, 90% of the global short-term rental units that had been reserved for this week, were canceled.

Greg Hague, a real estate broker and attorney, who owns Hague Partners and 72Sold says his company has listed many former short-term rentals in the past month, representing sellers who need to unload homes that are no longer producing income.

The turn of events has affected investors like Kory Wenzel, who owns three rental properties in the Phoenix area. Two of them are short-term rentals. The third is a traditional long-term rental.

“It should be survivable just being supplemental income. But for those who are doing it as a business, it might not be survivable,” said Wenzel.

photo credit: airbnb