Short term rental management company GuestReady is part of a new wave of property managers that are using technology to automate labor-intensive process of managing a rental property. Their services including listing to Airbnb and other platforms, checking in guests and arranging cleanings.

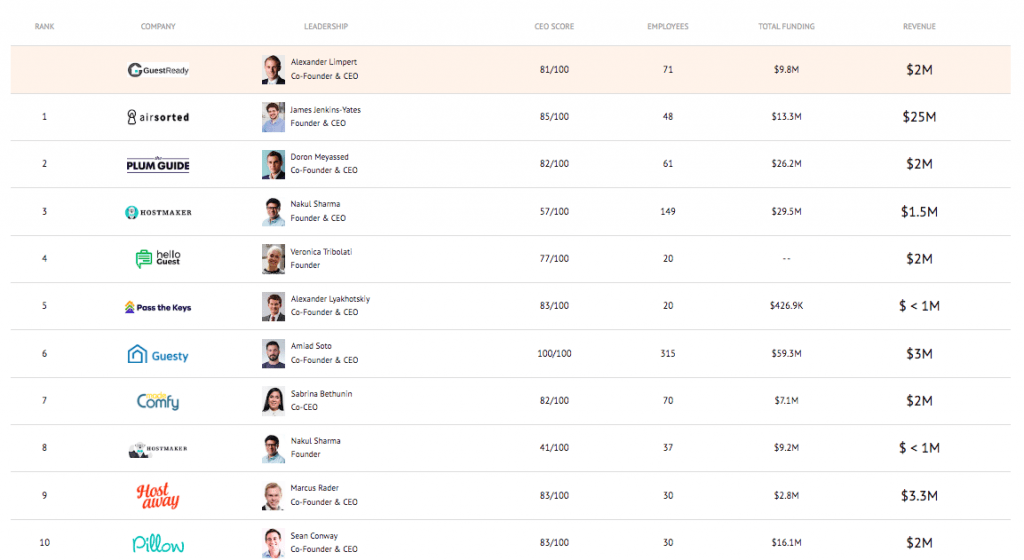

With the robust growth of short term rentals in major European cities, many companies have jumped on board to provide services, causing the market to become crowded. Among GuestReady’s top ten competitors, most of these companies, backed by venture funding, have generated revenues in the $2-$3 million range. Houst (formerly Airsorted) is the largest competitor, with revenues of $25 million, while Guesty has raised the most capital, at $59.3 million according to Owler. GuestReady and its top ten competitors have raised a total of $173.7 million with revenues estimated at around $44.5 million combined.

credit: owler

While the combined revenue is not huge, we suspect profits are negligible, if any. This sector needs to scale to deliver stronger revenue and profit growth.

GuestReady has indicated its strategy to capitalize on the fragmented property management market in Europe to become the continent’s largest provider of services to property owners, agents, and developers in assets under management.

Using M&A to Achieve Quick Expansion

In three years, GuestReady has grown to $1 billion or £900 million in assets under management, according to The Negotiator. This rapid growth is achieved through a number of M&A deals in the past two years. The company has raised nearly $10 million in venture capital.

The company’s current revenue model is a 12% annual management fee, with cleaning and laundry services costing extra, or a ‘guaranteed fixed income’ model, as reported by The Negotiator.

Targeting mostly urban markets in Europe, Asia, and the Middle East, GuestReady acquired a number of rival businesses to quicken their expansion into new markets.

It acquired Oporto City Flats, a short term rental operator in Portugal, and took over managing the portfolio of We Stay In Paris. Its most recent acquisition, which was also its largest to date, was BnbLord, the France-based startup that operates as the largest Airbnb host platform in France and Portugal.

GuestReady CEO Alexander Limpert told TechCrunch that the deal was a “strategic play to become the market leader in Europe.”

“We believe the market [for guest services] will consolidate,” he said, explaining that many young companies start out with promise but struggle to scale successfully once they hit 50-100 properties under management.

The company now employs 150 people and manages about 2,500 properties across 14 cities in the UK, France, Portugal, Dubai, Singapore, Hong Kong, and Malaysia.

Further Expansion in 2020 Through Licensing Technology

Armed with cash and opportunistic with acquisitions, GuestReady will also license its technology to quickly boost property count.

GuestReady will offer business-to-business services to other professional property managers and agents. They have already been testing this throughout 2019 with 15 partners and Limpert told The Negotiator in a recent interview that they will announce an official roll-out sometime in 2020.

The company will work with different landlord needs in different markets. According to Limbert, “Most of the London landlords who use his platform are second homeowners who want to generate extra income when they’re not staying in their property. The landlord profile is different in Portugal and Dubai where we are used more by professional landlords.”

According to The Negotiator, Limpert’s goal is “to increase his property count to 20,000 units by expanding into approximately a dozen UK cities within three years, partly by enabling larger landlords and letting agents to license his firms’ technology to fill void periods with short lets.”

Limpert still believes the play is in Europe, where he thinks the market is under-penetrated. He tells Techcrunch, “For now, we’re seeing so much potential in our current markets. London and Paris are two of Airbnb’s biggest markets globally, for example, with 60,000 properties…we manage a couple of hundred of them.”

As the sector continues to mature, there will certainly be further consolidation. GuestReady is hoping to emerge as a major player in Europe’s short term rental management market, but it still has a few significant competitors it needs to overcome.